A few weeks ago I joined Toastmasters. For your own entertainment I’m sharing with you my first speech, my icebreaker speech. It’s meant as a get to know me type speech. I hope you enjoy.

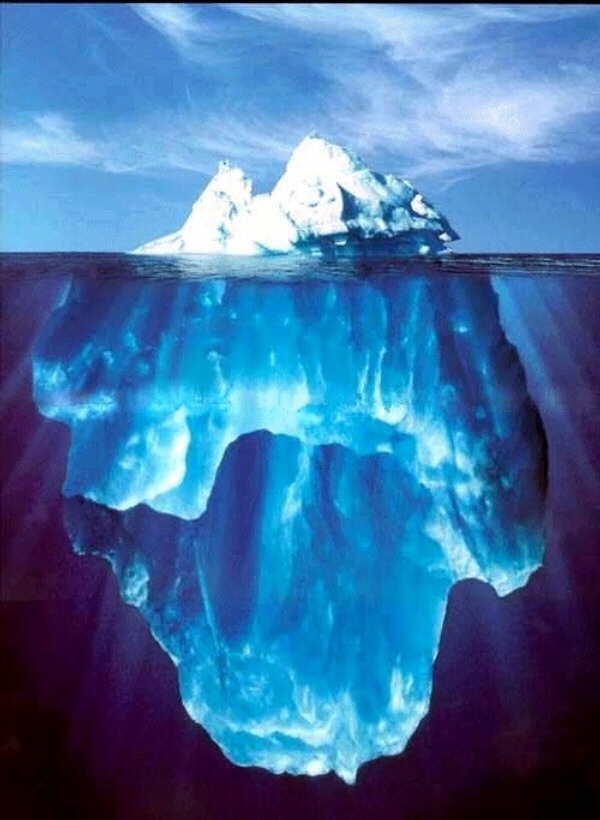

To break into this little iceberg, known as Remy, let’s start foundational. Every good house has a solid foundation, and I’m no exception. The three things that build my foundation are happiness, indepedency, and being different. In our world of creating acronyms (or acronymization, it’s a word I didn’t make up this time), we we call it H.I.Diff. You see your TV in HiDef, you can see Remy in H.I.Diff.

To break into this little iceberg, known as Remy, let’s start foundational. Every good house has a solid foundation, and I’m no exception. The three things that build my foundation are happiness, indepedency, and being different. In our world of creating acronyms (or acronymization, it’s a word I didn’t make up this time), we we call it H.I.Diff. You see your TV in HiDef, you can see Remy in H.I.Diff.

Happiness – I’m an annoyingly optimistic person, but not irrationally so. Strange balance here. Being happy is what you personally make of it. It’s not what your family, your spouse, or stuff you have (crammed in your garage). It’s your personal perception of the world. Your family, friends, and maybe some of that stuff Crammed in your garage help enhance your happiness. But ultimately you are in control of your happiness. For over 20 years my daddy has lived in Asheboro and my momma has lived in Asheville. Every week my dad drives 2.5-3hours to see my mom for the weekend and drives back to teach English at RCC. My dad is in Asheville every school break to spend with my mom. This has kept my parents happy for over 20 years. They aren’t divorced or separated, this is just how they keep their marriage happy. Growing up their were few fights that I can remember. Seeing this as the norm, my own happiness magnifier is in Toronto. I don’t get to see him every weekend, but he’s my happiness. I get to focus on growing my business, he gets to focus on expanding his culinary wisdom. We don’t have to talk about the mundane daily tasks, we get to talk about planning the next trip or the occasional big frustration or the big wins. It’s our untraditional happiness. We’ve been together 6 years, doing this for 2 years.

A good reason I can keep up the long haul distance is due to my independence. Previously it could be considered extreme independence. This was independence that started as a hormonal teen, this independence started in the womb. I was due on Halloween. That schedule did not work for me, I needed to be fashionably late. I decided my big entrance would be December 2nd. Yep, a month. I do what I want. Between ages of 1 & 2 in those crawling not yet fully walking stages I easily figure out how to help my daddy cook while he was out of the kitchen. I would push the chair to the gas stove and start turning knobs like daddy did. Silly parents just didn’t understand I could do it my self and wanted to hold me back. They hung up the chairs above my head and beyond the reach of my little arm. No worries, I knew they were hiding the stairs in the walls on the sides of the stove. I will just pull out the stairs, adults like to call them drawers, and work on the sides of the gas stove. No more knobs for the stairs. Luckily for my parents’ sanity I was a age to go to the daycare and that quickly came a big option. By age 5 I realize the road to real independence is a car. Every few months until age 12 I asked when I could learn to drive. Age 15/16 CLEARLY is just a recommended age. I’m Remy, that is clearly not written for me. They caved at age 12 because my mom was doing the reverse drive and was extremely sick. If I knew how to drive I would have at least driven the rest of the way home. I was responsible and tall enough to pass for 16.

A good reason I can keep up the long haul distance is due to my independence. Previously it could be considered extreme independence. This was independence that started as a hormonal teen, this independence started in the womb. I was due on Halloween. That schedule did not work for me, I needed to be fashionably late. I decided my big entrance would be December 2nd. Yep, a month. I do what I want. Between ages of 1 & 2 in those crawling not yet fully walking stages I easily figure out how to help my daddy cook while he was out of the kitchen. I would push the chair to the gas stove and start turning knobs like daddy did. Silly parents just didn’t understand I could do it my self and wanted to hold me back. They hung up the chairs above my head and beyond the reach of my little arm. No worries, I knew they were hiding the stairs in the walls on the sides of the stove. I will just pull out the stairs, adults like to call them drawers, and work on the sides of the gas stove. No more knobs for the stairs. Luckily for my parents’ sanity I was a age to go to the daycare and that quickly came a big option. By age 5 I realize the road to real independence is a car. Every few months until age 12 I asked when I could learn to drive. Age 15/16 CLEARLY is just a recommended age. I’m Remy, that is clearly not written for me. They caved at age 12 because my mom was doing the reverse drive and was extremely sick. If I knew how to drive I would have at least driven the rest of the way home. I was responsible and tall enough to pass for 16.

Though many of these stories can already illustrate the ways I’m different. For me it’s all about perspective. The norm for me can be seen as really strange for someone else. Maybe you are the someone else. To have something that is different you have to have a historical or agreed upon “normal” that is the base line. Something can only be different when you compare it to something else. Different can be good, different can be bad. But remember the first thing I said, your happiness is ultimately up to you. Every situation is different but the average for me different is good. I don’t want to be Center of attention, but I also don’t want to be lost in the herd. Some people might say I’m off beat and I tell them they’re listening to the wrong song.

I consciously do things a little differently than many people you may know. It helps me stand out from the herd. Let’s me keep my independence so that I can live my happiness.

I hope you can find your drum beat that beats a little bit differently so that you can find your ultimate happiness.

You’re welcome to come live H.I.Diff with me.

Thank You. ![]()