The very root to many monetary issues small and large can typically be found to be from one simple little word, or the LACK of one simple word. “No”

Whether it’s choosing to say “No” or avoiding saying “No” is your issue, you’re not alone. It can be for many different reasons. Typically it’s not a conscience decision to avoid saying “No,” it’s an emotional decision.

Let’s take a moment to review some typical scenarios to think about where to say “No” but maybe choose not to.

Family

Whether it’s your parents, kids, brother, sister or best friend, it can be very hard say no to your family and friends. Let’s think about a kid wanting to go out to the movies for the weekend. He tells his parents that he wants to go out for the weekend. The parent hand him $50 and tells him to have fun. As the parent, you failed to say “no,” so what does that me for you? Well, you’re $50 poorer for one. Next you haven’t set perimeters and now you’ve set your kids up for just asking and they shall receive. The more often this type of situation happens, the harder it will be to stop. On the flip side of this same example, what if you were the kid, what do you get out of this? Yes, you may be $50 richer, but at what cost? What does this teach you about the real world? Not much. The real world will not just say “yes” to your every desire so it’s really setting real life expectations up incorrectly and setting you up for future failure.

Think of this same example when it comes to friends and family that constantly ask for money. It can be the friend that always gets himself in trouble and needs to be bailed out all the time or the brother/sister that always leans on you to get them out of a financial jam.

Friends

Even if you don’t have friends that are constantly asking directly for money, many can still drain your resources in a different way. Do you like to go and “hang out” at the bar or go out to movies on a constant basis? Being social is completely healthy and needed for a happy life, but it does not necessarily mean it should require to you spend money constantly to keep everyone happy. Let’s say for fun you go out every weekend. The bar scene Friday nights, the club on Saturday, and maybe dinner & a movie. If you think of just the basic cost of that 1 weekend it can easily be in the hundreds, $100-$300 PER weekend. You have 4 of those in a month and it’s $400-$1200 any given month. You can still be a socialite on the weekends, but finding a way to cut costs and being mindful of what you spend. If you save what you would have spent, you’re well on your way to saving a useful emergency fund.

Even if you don’t have friends that are constantly asking directly for money, many can still drain your resources in a different way. Do you like to go and “hang out” at the bar or go out to movies on a constant basis? Being social is completely healthy and needed for a happy life, but it does not necessarily mean it should require to you spend money constantly to keep everyone happy. Let’s say for fun you go out every weekend. The bar scene Friday nights, the club on Saturday, and maybe dinner & a movie. If you think of just the basic cost of that 1 weekend it can easily be in the hundreds, $100-$300 PER weekend. You have 4 of those in a month and it’s $400-$1200 any given month. You can still be a socialite on the weekends, but finding a way to cut costs and being mindful of what you spend. If you save what you would have spent, you’re well on your way to saving a useful emergency fund.

Yourself

This happens in a few ways. Spending, not tracking your spending, not saving, and putting it on credit without paying it off monthly. Think about these typical situations:

This happens in a few ways. Spending, not tracking your spending, not saving, and putting it on credit without paying it off monthly. Think about these typical situations:

You work hard and “deserve” that night out or Starbucks on the way to work. Here you neglect to say no to spending. You’re also probably not tracking your spending which is just as important, I mean it’s a couple bucks, what’s the big deal? It can at times be ok to spend on yourself, but if you’re not tracking what you’re spending, how do you know what is ok to spend? Also many times these habits aren’t just 1 timers, they happen on a consistent basis and quickly can drain your resources. A few bucks here and there quickly add up and you’re spending more than you know it on coffee, drinks, and overpriced nights out.

On the flip side of spending with what you have is spending what you don’t have AND not saving. If you’re driving through those windows and charging on your Visa, Mastercard, etc and not paying off the balance each month you’re walking on a tight rope. If you’re having to use your credit cards to pay for daily expenses you will be wasting money on interest rates. Also, when an emergency hits, those credit cards will more than likely get maxed out quickly.

Working Hard: Saying “No”

I know it may seem silly to instruct people on how to say “no” but it can really get you to think. In the first example when it comes to family it’s about setting clear boundaries and expectations. At first it might be hard to tell your family no, and it can feel awkward to set expectations for your family but it can be the easiest. If you think about it, they love you and want the best for you, so if you can set the expectation by explaining WHY you are doing what your doing in terms of yourself AND them, they should be understand. From this example think about it like this: “I know you want to go out with your friends, so that you can earn the money you need to go out I need you to do x, y, z first.” You didn’t say no, you set the expectation that they need to earn the money they want to spend… Just like real life. Imagine that. After a few different instances just like this, instead of asking for money, they’ll ask what they need to do to be paid.

The harder example is telling your friends no. Setting expectations can feel a little awkward and unnatural. Though many friends can be like family, it can be strange to “set expectations” with your friends when it comes to cutting back on social events out. You don’t want to seem like you’re in financial troubles and you want to show that you can “keep up” with their own social activities. First, you don’t know their financial status and they may be trying to keep up with you so this can be an endless logic cycle. If you take the first step, you can actually be helping them cut back too if you think about it. Keep it real and honest and find alternatives that are cheaper. If you have to go out to the bar scene, you can buy the special, or choose water. I’m not a drinker myself so it makes my life cheaper. Cut back on movies to 1 a month if you go every weekend. Try movie nights at home and have a pot luck so everyone can enjoy reasonably priced food and not overpriced candy and popcorn. (Don’t you love it when you’re saving money AND becoming healthier, or at least the opportunity to become healthier)

The harder example is telling your friends no. Setting expectations can feel a little awkward and unnatural. Though many friends can be like family, it can be strange to “set expectations” with your friends when it comes to cutting back on social events out. You don’t want to seem like you’re in financial troubles and you want to show that you can “keep up” with their own social activities. First, you don’t know their financial status and they may be trying to keep up with you so this can be an endless logic cycle. If you take the first step, you can actually be helping them cut back too if you think about it. Keep it real and honest and find alternatives that are cheaper. If you have to go out to the bar scene, you can buy the special, or choose water. I’m not a drinker myself so it makes my life cheaper. Cut back on movies to 1 a month if you go every weekend. Try movie nights at home and have a pot luck so everyone can enjoy reasonably priced food and not overpriced candy and popcorn. (Don’t you love it when you’re saving money AND becoming healthier, or at least the opportunity to become healthier)

Now comes the hardest person to stick with “No” – Yourself. It’s easy to tell yourself “no” because you understand the reasoning. However, sticking to it is much harder. Temptations happen everyday. It can be something that seems tiny like picking up a quick bite in the drive thru to save time. It could be something larger like getting a new car or going on a shopping spree because you got a bonus check. When you’re responsible for yourself it can be hard to tell yourself no. You work hard and deserve some bonus time to yourself, so why can’t you splurge on something little for yourself? The trouble that gets you in is consistently splurging on the “little” things. Those little instances add up quickly. It will take some training and a good support structure from friends and family but if you set goals for yourself, such as a vacation fund or Christmas fund, it will be easier to see the big picture and say “no” to the little stuff . Make sure you have short, mid, and long term range goals. When you’re out and about think about what is going to get you to those goals. If it doesn’t contribute to that Caribbean vacation or Christmas fund for the kids, is it worth spending the money? Personally I know I can skip those run through the drive through if the alternative is sitting in the sun on a gorgeous beach.

Now comes the hardest person to stick with “No” – Yourself. It’s easy to tell yourself “no” because you understand the reasoning. However, sticking to it is much harder. Temptations happen everyday. It can be something that seems tiny like picking up a quick bite in the drive thru to save time. It could be something larger like getting a new car or going on a shopping spree because you got a bonus check. When you’re responsible for yourself it can be hard to tell yourself no. You work hard and deserve some bonus time to yourself, so why can’t you splurge on something little for yourself? The trouble that gets you in is consistently splurging on the “little” things. Those little instances add up quickly. It will take some training and a good support structure from friends and family but if you set goals for yourself, such as a vacation fund or Christmas fund, it will be easier to see the big picture and say “no” to the little stuff . Make sure you have short, mid, and long term range goals. When you’re out and about think about what is going to get you to those goals. If it doesn’t contribute to that Caribbean vacation or Christmas fund for the kids, is it worth spending the money? Personally I know I can skip those run through the drive through if the alternative is sitting in the sun on a gorgeous beach.

The power of saying “no” is created when expectations are set appropriately for anyone that has any passing sway of your finances. Setting expectations can be hard, but not impossible. Family and true friends will understand why you are setting the expectations and might use you as a role model.

When setting expectations try:

1) Don’t give them specific numbers, just tangible reasons and goals. “Hey, I’m trying to save up for the Caribean. I’m going to hold off going out for a while”

2) Find alternative that everyone can agree upon. “Why don’t we just hang out at my house and grab a redbox movie?”

3) Communicate what’s in it for them. They could be learning from you as role model, but I wouldn’t say it like that. They can save money too so they might be able to come to that Caribean vacation with you. Vacations can be much more fun when you have friends with you. “It would be great if you could come with us. Why don’t we plan on going together? It would be way more epic if we were both partying at the island”

So what are your thoughts? I know you have the power to say no, so what is your story?

Being in the industry I’d have to say 50% of the people I know asked my blood pressure and stress levels recently. I’m thankful I have such good people around me that are concerned with my health, but I calmly explain the following:

Being in the industry I’d have to say 50% of the people I know asked my blood pressure and stress levels recently. I’m thankful I have such good people around me that are concerned with my health, but I calmly explain the following:

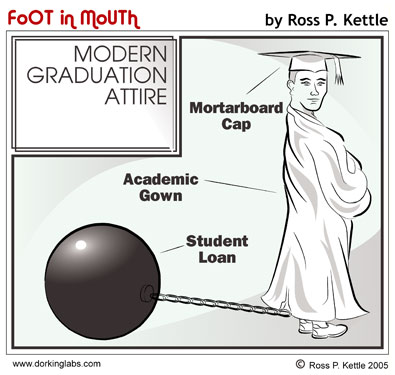

First of course is the college or university you want to attend. How much is that going to cost? The sticker price isn’t the final price in many cases and is negotiable. Also as a cautionary tale from the last horror story, make sure the school you want to go to has substance. Do some research on the college as well as the field you are interested in. Make sure the expectations the college is giving you is reasonable. If it seems too good to be true ask for referrals or see if you can chat with some recent graduates. They will be the best gauge if it’s worth spending the money they are asking to attend the college.

First of course is the college or university you want to attend. How much is that going to cost? The sticker price isn’t the final price in many cases and is negotiable. Also as a cautionary tale from the last horror story, make sure the school you want to go to has substance. Do some research on the college as well as the field you are interested in. Make sure the expectations the college is giving you is reasonable. If it seems too good to be true ask for referrals or see if you can chat with some recent graduates. They will be the best gauge if it’s worth spending the money they are asking to attend the college.