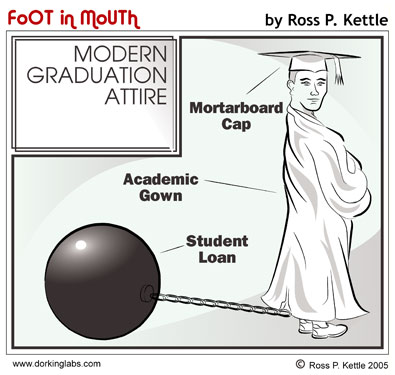

For the times I just want to mindlessly read silly things, such as best dressed at some awards show I don’t watch or why a NFL superfan has quit his team, I go to Yahoo! News. While turning the pages of the stories, I came across a story about student loans. After turning my brain back on I read a few of the many horror stories about student loans. You can check out the story here.

For the times I just want to mindlessly read silly things, such as best dressed at some awards show I don’t watch or why a NFL superfan has quit his team, I go to Yahoo! News. While turning the pages of the stories, I came across a story about student loans. After turning my brain back on I read a few of the many horror stories about student loans. You can check out the story here.

I was VERY lucky that my parents/grandparents helped me go through college without any student loans. For many now it’s just a way of life that they will never pay down. Every month they write a check to Sallie Mae or private bank that holds the loan. Since many are set up like a mortgage, the payments are all interest first so even those payments aren’t paying off the debt itself, just the interest for the debt. Sounds pretty depressing to me. For those parents and students shopping around now let’s take these horror stories and learn from them so we don’t repeat the same mistakes. There are a few areas to look at when gauging your finances to pay for college.

First of course is the college or university you want to attend. How much is that going to cost? The sticker price isn’t the final price in many cases and is negotiable. Also as a cautionary tale from the last horror story, make sure the school you want to go to has substance. Do some research on the college as well as the field you are interested in. Make sure the expectations the college is giving you is reasonable. If it seems too good to be true ask for referrals or see if you can chat with some recent graduates. They will be the best gauge if it’s worth spending the money they are asking to attend the college.

First of course is the college or university you want to attend. How much is that going to cost? The sticker price isn’t the final price in many cases and is negotiable. Also as a cautionary tale from the last horror story, make sure the school you want to go to has substance. Do some research on the college as well as the field you are interested in. Make sure the expectations the college is giving you is reasonable. If it seems too good to be true ask for referrals or see if you can chat with some recent graduates. They will be the best gauge if it’s worth spending the money they are asking to attend the college.

Next make sure to apply for as many grants and scholarships as possible. Here are a few resources:

- Scholarships.com

- College Grants – CollegeScholarships.org

- CFNC.org – for those in North Carolina

- Daily Finance Article – For those with a little extra time to read

- Finaid.org – Financial

A quick note on scholarships & grants: make sure to read the fine print. A full ride may require a minimum GPA or other requirements such as working the first 2 years out of college at a certain job. Make sure those requirements are doable in the near future, if you have doubts now, they will probably only get worse later.

Now that you have a solid number (Cost of College MINUS all grants/scholarships MINUS any help from family/friends/savings) now you can shop around for a student loan. Of course interest rate is very important, so the lower the better, but also think about how long the payments are and what exactly will that look like right out of college? That is where the Vertex24’s handy dandy Amortization Loan spreadsheetcan come in handy. This will help you figure out your monthly cost based of the total amount, interest rate, start date and term.

To get a real gauge on if this payment is ACTUALLY reasonable let’s make a little Post-Graduation budget. For a fun example, let’s say you graduate as an mechanical engineer. We’ll assume you get a mechanical engineering job right out of college that starts at $50,000/year. The Monthly budget might look something like this:

| Monthly Income(+) | $4166 |

|

Expenses(-) |

|

| Rent | $600 (1 bedroom apartment or with a roommate) |

| Electric, Water, Trash | $100 |

| Internet | $50 (You know you have to have fast internet) |

| Car Insurance | $75 (This is cheap if you haven’t hit 25 yet) |

| Car Maintenance | $50 (even if you don’t use it every month, save it) |

| Food – Groceries | $400 ($100/week) |

| Food – Dining Out (Fast Food, Bars, coffee, etc) | $300 ($10/day) |

| Going Out | $500 ($125/weekend) |

| Savings – Emergency | $416 (Save 10% for emergencies) |

| TAXES | $1041.50 (25% Tax Bracket) |

| Student Loan Payment | ???? ($217.50 based on this budget) |

| 401K savings | $416 (10% of salary) |

Based on this lifestyle, $217.50/mo is the only thing that’s left to pay back student loans. This budget is very rough and doesn’t account for some expenses that a new grad may have such as car payment, gym membership, new professional wardrobe, etc. Though 401k & savings numbers may seem like easy targets to pull money from I would not advise seeing those parts of the budgets as easy targets. Those are your nest eggs and emergency plans when life throws you a curve ball. If you don’t automatically save each month, you’re asking for trouble down the road when life throws you a tree full of lemons.

Now let’s take a look at what it might look like if you don’t get that mechanical engineering job right out of college and you can land a job at $13.50/hr full time until the right job comes along.

| Monthly Income(+) | $2340 |

|

Expenses(-) |

|

| Rent | $400 (Roommates) |

| Electric, Water, Trash | $75 (split with roommates) |

| Internet | $25 (You know you have to have fast internet) |

| Car Insurance | $75 (This is cheap if you haven’t hit 25 yet) |

| Car Maintenance | $50 (even if you don’t use it every month, save it) |

| Food – Groceries | $200 ($50/week) |

| Food – Dining Out (Fast Food, Bars, coffee, etc) | $150 ($37.50/week) |

| Going Out | $250 ($62.5/weekend) |

| Savings – Emergency | $234 (Save 10% for emergencies) |

| TAXES | $351 (15% Tax Bracket) |

| Student Loan Payment | ???? ($296 based on this budget) |

| 401K savings | $234 (10% of salary) |

Yep, you’ve cut back a lot, and can even afford a higher monthly payment. Is that what your student loan agreement(s) look like though? Under $300/month? The average student debt is now $27,000 and if the interest is 7%, that’s $179.63/month, so maybe. Clearly for those going to a school with a much larger tuition bill it may not be as easy to see a payment less than $300/mo.

Do you have a student loan story you would like to share? Horror stories or happy endings are both welcome. I always love hearing feedback.