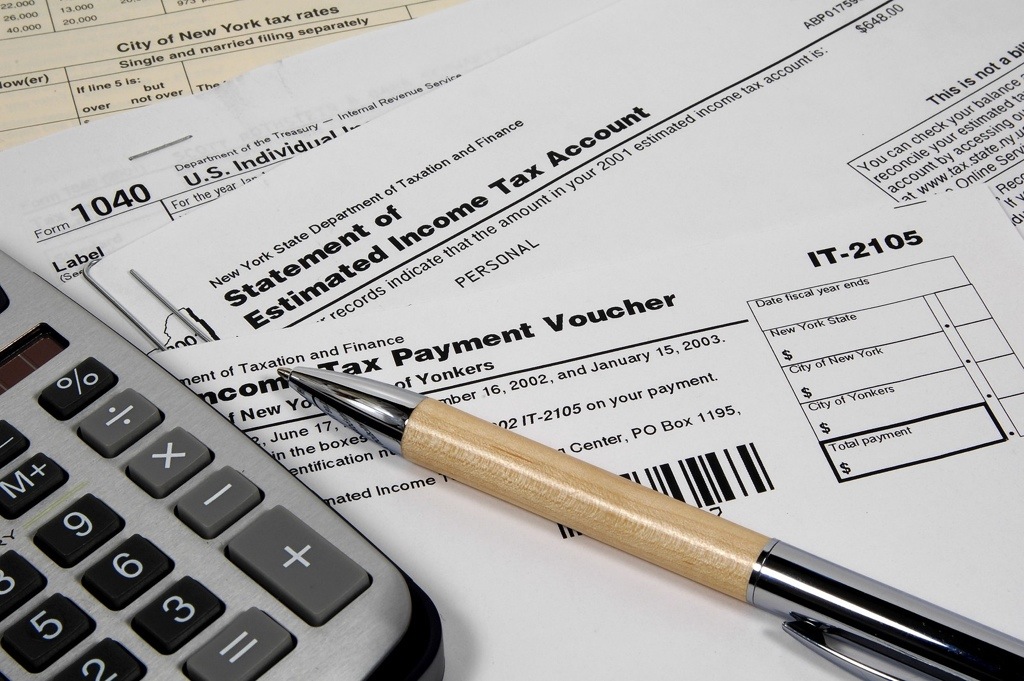

As another Tax season ends, another year of preparation begins. The best (I use this term loosely) tax seasons are ones with less headaches, heartaches, and possible heart attacks (the three H’s of tax season). How do you do that?! Well utilizing technology can help keep things in order so that when tax season comes around next year you are ready without worry.

Here are some great apps/sources to keep your daily life organized so you can send your CPA (always recommended) all your documents early and they won’t have to ask too many questions.

1) Calendar. I use google calendar, but you can also you outlook or iCal. This may seem a bit odd in regards to taxes. It can keep things in order about where you were with who; whether it was for business or pleasure. Make sure whichever calendar you use it is easy to get to no matter where you go or what you are doing.

2) TripLog. Best way I have found to track mileage. I’ve said it before in previous post but will say it again. It’s a great tool if you’re doing 1099 work and need to deduct mileage. The most expensive version is more than worth it (and you can claim it as a business expense). Make sure your GPS is turned on and the app will track how many miles you go when turned on. The full featured version can automatically turn on when you go more than 5mph. You can file away business, personal, and charity drives right from the app and then export them monthly. A good practice I like to have is print the report at the end of the month and staple it to my calendar so I know what I was doing when.

3) Expensify. For all those dinner and lunch meetings or just when you have to go out and get more stickies. This app helps you keep track of all the receipts by taking pictures of them and storing the reason for the expense. I know you have a separate credit card for business expenses because you’re a smart cookie so you can tie your business credit card account to Expensify and it will automatically import charges for you to adjust and delegate.

4) Genius Scan. When you need to quickly send a copy of a document to your CPA but a fax isn’t available, this is your app. The only caveat I would put to this is make sure you have a good camera on your device. Once you take a picture in genius scan (or equivalent app) you can crop it to just the document itself and send via email and/or save it as a PDF. This is also great if you don’t feel it’s a receipt but needs to be documented for tax purposes.

Great practices to keep you cool throughout the year (to prep for tax season)

– Make sure your calendar is up to date daily. Don’t forget to put in last minute meetings, even if its just for coffee.

– Talk with your CPA about common deductions. If you’ve had one for a while they should be able to give you a specific list. Many times its meals, mileage, and business supplies, but there can be more depending on what you are doing. Make sure to wait a week or so after April 15th so you can give your CPA a break.

– In case you haven’t already, get a business only credit card that will never be used for personal use. Your CPA will hug you (and maybe even me) when you do this if you haven’t already.

– At the end of the month (or start of the next), print off the updated calendar, Expensify reports, and TripLog reports and file away for the given month. Easy thing to do is put a reoccurring reminder in your calendar to set aside time to do this each month. First time it might take an hour, but it usually only takes 15min. If it only took you 3 hours the ENTIRE year to do your taxes I think you would be able to three H’s of tax season.

Don’t forget that each year tax laws change so there may be some things that your CPA will ask you because they know you and your business so well.

Make sure to check back for any updates and additional tips from local CPAs.