Whether I’m at a networking event, meeting with clients, or forming a wonderful new business partnership, I’ve heard a theme recently. Estate planning is the buzzword. A few people I can understand, but so many in such a short period just has to be more than a coincidence.

I’m sure my attorney friends are tired of me bugging them asking them pesky little questions. Which to side track a bit, it is always an “it depends” kind of answer. Nothing is as straightforward as it should be when it comes to the law books.

Estate planning will mean different things to different people. It can mean a “simple” will that you print off the internet and fill in the blanks or it can be a complicated Trust situation. Every family is different. When it comes to estate planning, there is no simple answer and it, like the law, will have an “it depends” kind of answer.

Estate planning will mean different things to different people. It can mean a “simple” will that you print off the internet and fill in the blanks or it can be a complicated Trust situation. Every family is different. When it comes to estate planning, there is no simple answer and it, like the law, will have an “it depends” kind of answer.

Here is a short list of things to consider when planning how you want to leave your legacy behind.

1) Make sure you have an accurate, up to date inventory so there’s no grey zones. Check out Nino’s www.thestuffinmyhome.com to catalog your belongings. This list not only should include physical items, but money, investments, and insurance to name a few.

1) Make sure you have an accurate, up to date inventory so there’s no grey zones. Check out Nino’s www.thestuffinmyhome.com to catalog your belongings. This list not only should include physical items, but money, investments, and insurance to name a few.

2) Hire an experienced estate planning lawyer. The reason I say this is because I can speak from personal experience here. My grandfather hired a lawyer to draft his will. He was a friend of the family that dealt more with oil & mining law than estates. He made a very large mistake and almost costs the family lots of money. It eventually worked out, but it could have ended very badly. If you need a list of suggestions, please let me know and I’ll send you some good names.

3) Be open and honest with your lawyer on who you do and don’t want in your will. This will more than likely include telling the lawyer your family drama and dirty secrets. This isn’t gossip, it will help the attorney figure out the best route to take your plan from a tactical point. They’re bound my attorney/client privilege and want to do what’s in YOUR best interest. Everyone has some kind of family drama and/or secrets, so it probably won’t shock the seasoned estate attorney.

4) Make sure your financial planner is in the loop with your estate attorney. They should go to the meetings and make sure everyone is on the same page. They can also help the attorney with the financial side so you don’t forget anything. Having them work together will not only save a lot of time, it can save a lot of money when you’re considering tax implications of your estate plan. If you don’t have a financial planner, or you don’t have one that will go with you to the estate attorney, give me a call and we can fix that.

5) Be involve and follow up. Make sure to ask lots of questions until you understand. Having a good financial planner with you can really help with the jargon gap between attorney & client sometimes. If there is something the attorney or the planner need you to do, make sure you do it! Once you have a plan in place, make sure you check on it every so often as laws will change and may effect your plan.

These are just some things to consider when developing your own plan of action around your legacy.

Estate planning can be very involved, so make sure you have the right team members to win.

Until next time wonderful readers!

-Financial Landscaper

var _gaq = _gaq || [];

_gaq.push([‘_setAccount’, ‘UA-35874269-1′]);

_gaq.push([‘_trackPageview’]);

(function() {

var ga = document.createElement(‘script’); ga.type = ‘text/javascript'; ga.async = true;

ga.src = (‘https:’ == document.location.protocol ? ‘https://ssl’ : ‘http://www’) + ‘.google-analytics.com/ga.js';

var s = document.getElementsByTagName(‘script’)[0]; s.parentNode.insertBefore(ga, s);

})();

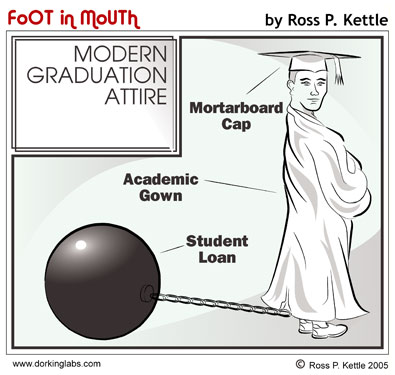

First of course is the college or university you want to attend. How much is that going to cost? The sticker price isn’t the final price in many cases and is negotiable. Also as a cautionary tale from the last horror story, make sure the school you want to go to has substance. Do some research on the college as well as the field you are interested in. Make sure the expectations the college is giving you is reasonable. If it seems too good to be true ask for referrals or see if you can chat with some recent graduates. They will be the best gauge if it’s worth spending the money they are asking to attend the college.

First of course is the college or university you want to attend. How much is that going to cost? The sticker price isn’t the final price in many cases and is negotiable. Also as a cautionary tale from the last horror story, make sure the school you want to go to has substance. Do some research on the college as well as the field you are interested in. Make sure the expectations the college is giving you is reasonable. If it seems too good to be true ask for referrals or see if you can chat with some recent graduates. They will be the best gauge if it’s worth spending the money they are asking to attend the college.